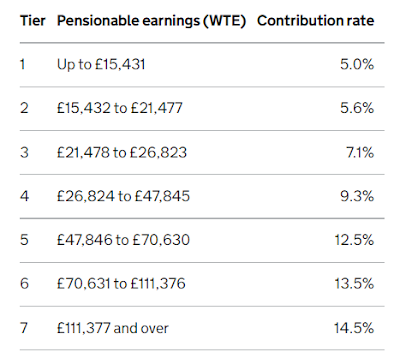

Apologies for the radio silence recently — it’s been a hectic few months balancing clinical work, practice meetings, and everything else life throws at us. I’ve been meaning to write more regularly, but as many of you will understand, time just slips away. That said, a recent development caught my attention — and if you’re a GP partner, it’s one you really can’t afford to miss. 🚨 No Additional Funding for 2026/27 Pay Uplifts Health Secretary Wes Streeting has formally written to the DDRB (Review Body on Doctors’ and Dentists’ Remuneration) and confirmed that there will be no extra money for GP pay rises in 2026/27. LINK That’s right — no new funding whatsoever to support any pay awards next year. If the DDRB recommends a 2–4% increase for GPs, salaried doctors, or practice staff, the government expects us to fund that out of our existing budgets. 💸 What does this mean in practice? If you're a GP partner, here’s the reality: No uplift to the global sum has been promis...