NHS Pension contribution changes - April 2022

Going back to my previous introductory NHS pension post, employee contribution to the NHS pension was tiered dependant on your earnings. Below was the previous banding and employee contribution rates.

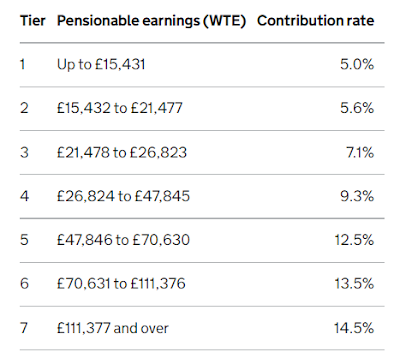

New proposals from the Department of Health and Social Care (DHSC) will see some of these percentages change come April 2022. For the NHS pension scheme to work, an average of 9.8% employee contribution is needed from all members - this is known as the employee contribution yield.It seems that it was decided that the lower earning members don't contribute enough, and the higher earners contribute too much. Also what will be changed is that it will be based on actual pay, not the WTE. Below is the new contribution payment bands and percentages that will be introduced from April 2022 and then changed the following year in 2023.

This is a take-home pay cut for lower earning members of the scheme, and is only really advantageous to doctors and higher earning management. The argument however is that the pension is the same proportion of your earnings for everyone. They could have made everyone just pay the 9.8% rate but they felt it would deter lower-earners contributing. So the higher earners are helping boost up the overall contributions to get to that magic 9.8%.

The earnings ranges for each tier would be increased annually, in line with uplifts that are applied to Agenda for Change (AfC) pay bands. This will mitigate the cliff edge issue that sees some members charged a higher contribution rate because a pay uplift has put them into a different tier.

You can find the proposed document here if you want to view it for yourself.

If you found this useful, please share below.

Comments

Post a Comment