Delay of NHS Employee Pension changes

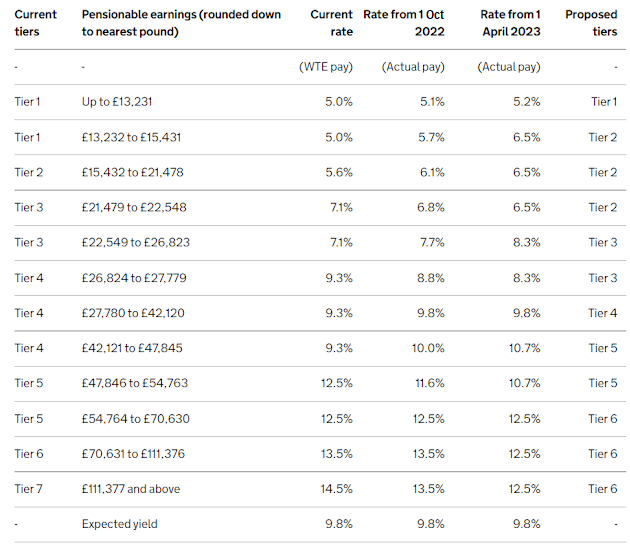

Previously I discussed the proposals to change the amount of that employees contribute to the NHS pension. Those on lower incomes will be contributing more and those on higher incomes will contribute less. This was meant to be rolled in this April 2022, but this is now going to be started from October 2022 with the final changes to the employee contributions in April 2023.

Whilst this generally seems to help the higher earning staff of the NHS, usually doctors and managers, this will reduce the take home of those already feeling the squeeze of the NI rise and increased cost of living of the current times. There are very specific income bands where the rate drops. These are:

- Between £21,479 and £22,548 (from 7.1% to 6.5%)

- Between £26,824 and £27,779 (from 9.3% to 8.3%)

- Between £47,846 and £54,763 (from 12.5% to 10.7%)

- Between £70,631 and £111,376 (from 13.5% to 12.5%)

- Above £111,377 (from 14.5% to 12.5%)

I think the delay is a response to this cost of living squeeze, hopefully allowing inflation to settle down and giving those people more take-home pay until it gets better.

This will make the end of year annual certificate of pensionable profits more complicated than it already is, as it will need to account for a mid-year change in contribution. As much as I love maths, I'm glad I have an accountant who will deal with it.

Please share below.

Comments

Post a Comment