ISAs v SIPPS for retirement

I was having a discussion recently about what can those not relying on an NHS pension can do for retirement. Workplaces are legally required by law to give a pension, and though most of the time you should definitely take it (it's effectively extra income if your employer will add to it), it may not be invested in the appropriate funds or might be charging high fees. The two main methods most talked about are Stocks and Shares ISAs (Individual Savings Account) and SIPPS (Self-Invested Private Pensions). They effectively are tax wrappers that shield the growth of the equities within them from tax. Below Are my takes on the pros and cons of each of these products, and when they may be appropriate for some.

Stocks and Shares ISA

ISAs come in two varieties, cash and Stocks and Shares (S&S). Generally given low cash interest rates, people would try use the S&S ISA to grow their wealth. The benefit of using it, is that any growth within the ISA is all tax free. You can invest in individual stocks (Tesla, Apple, Facebook, etc.), ETFs and traditional funds. There are quite a few platforms now you can use, from big traditional platforms like Hargreaves Lansdown, Vanguard and Fidelity to newer app based platforms such as Trading 212 and Freetrade. They either charge an annual fee (fixed or percentage) or make their money on the spread between the buy and sell price of the asset.

You can only put in a maximum of £20,000 every tax year across all your ISA accounts (Cash, S&S, Lifetime, Innovative Finance). However, that's quite a large amount so in reality, not too big a deal unless you are earning a lot. If you consider that this taken from your income post-tax, you have to be on a good salary after you consider tax, student loan, rent/mortgage and bills to be deducted. There is no maximum to the total amount you can store in an ISA which is considered a benefit compared to pensions.

If you're married and you pass away with an ISA, your partner will be able to inherit your ISA tax-free. However if you die with an ISA with no partner, then it forms part of your estate and therefore liable to inheritance tax if your estate is higher than the tax-free threshold (currently 40% of anything over £325,000).

SIPPS

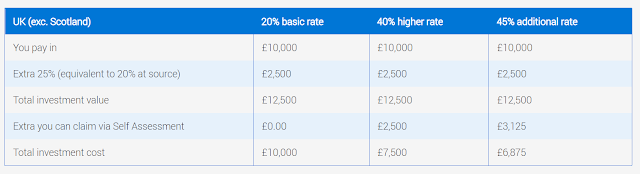

SIPPS are another tax-free vehicle to grow wealth. However the main difference is that the money is considered to be added gross from your salary, before tax deductions. Most SIPP providers will claim back the 20% tax on your contribution from the government and invest that automatically. If you pay more than 20% income tax (40% higher rate and 45% additional tax) then you will need to claim that back via self assessment. The table below shows best the actual cost in investing in a SIPP.

As you can see, the higher tax you pay, the cheaper the cost. Due to compounding, the extra money does work out better when it comes to retirement.

If someone who was a normal rate income tax payer dropped £10,000 a year into an ISA and person and dropped £10,000 a year into a SIPP (which gets topped up to £12,500 via tax relief), then after 20 years, assuming 5% annual growth, the ISA has grown to £373,725.50 whilst the pension has grown to £467.156.87, a difference of £93,431.37 despite the same initial investment. This works out even better if you are a higher rate or additional rate tax payer when paying in.

Other benefits include using your pension to allow you to reduce your adjusted income for childcare purposes (dropping that income £50k for child benefit or £100k for free 30 hour childcare). It is also inherited tax-free if you pass away below the age of 75, it is not counted as part of your estate for inheritance tax purposes. If you pass above the age of 75, it is passed to your beneficiaries and they can withdraw at their marginal rate.

As mentioned in previous posts, there are some restrictions to your pension pot. You can currently only contribute £40,000 or the equivalent of your gross annual salary (whichever is lower) every tax year. If you go over, you can use unused pension contributions from the previous 3 years otherwise you will be taxed extra at your marginal tax rate. Also, there is a lifetime allowance which is currently £1,073,100, above this amount, you are taxed on anything above this upon withdrawal.

Now when you withdraw from a pension, it is taxed on the way out unlike an ISA which is all tax-free. However you get a 25% tax free lump sum and also control about how you much you'd like to take, Because of this, you can use the personal allowance every year to take money out tax free. How to do this best is a complicated topic, and I suggest the video below about the best way to withdraw.

Which one is best is a totally individual and personal decision. If you want to be able to have full control of when and how you want to withdraw your money and not worry about tax, then ISAs may be better. If you want to in theory have a better rate of return but more restrictions and considerations of taxes, then a SIPP may be your thing. Personally, as I don't plan to retire that early, if I didn't have a NHS pension, I would weight my investments more towards my pension as it would give the most bang for my buck.

Another tax-free vehicle I didn't mention specifically was the Lifetime ISA, which I think is also a good vehicle for retirement purposes, something I will discuss in the next post.

Please share below if you found this useful.

Comments

Post a Comment